Forex trading can be a unpredictable and profitable endeavor. Despite this, achieving success in this challenging market requires more than just chance. It demands a solid understanding of technical analysis, fundamental analysis, and risk management principles.

To truly dominate Forex trading strategies, traders must continuously refine their skills and knowledge. This involves implementing diverse trading techniques, spotting profitable market opportunities, and skillfully managing risk to minimize potential losses.

A well-defined trading plan is essential for success in Forex. This plan check here should outline your speculation goals, risk tolerance, preferred periods, and the specific strategies you will utilize. Furthermore, it's absolutely necessary to undertake thorough market research and analysis before making any trades.

Finally, remember that Forex trading is a ongoing process that requires patience, discipline, and a commitment to improvement. By remaining informed, adapting to changing market conditions, and consistently refining your strategies, you can increase your chances of achieving long-term success in the Forex market.

Unlocking Profit Potential in the Forex Market

The forex market presents a dynamic and thriving landscape for savvy traders seeking to generate profits. With its round-the-clock trading sessions and substantial liquidity, the forex market offers extensive opportunities for investors to {capitalize{ on price fluctuations and achieve financial returns. However, navigating this complex ecosystem necessitates a calculated approach.

It's crucial to hone a deep understanding of market dynamics, technical analysis tools, and risk management strategies. By implementing these foundational elements, traders can minimize risks and enhance their chances of obtaining profitable outcomes in the forex market.

Navigating Currency Fluctuations: A Forex Trader's Guide

Trading in the foreign exchange market presents a unique set of challenges for astute traders. One of the most prominent hurdles is navigating the volatile nature of currency fluctuations. Exchange rates are constantly oscillating, impacted by a multitude of factors ranging from economic figures to geopolitical events. A successful forex trader must possess a deep understanding of these forces and develop effective strategies to manage the risks associated with currency movement.

- Implement technical analysis tools to identify trends in currency pairs.

- Spread your portfolio across multiple currencies to limit exposure to any single market.

- Stay informed global economic news and events that could influence currency valuations.

Understanding Forex Technical Analysis

Technical analysis in forex is the study of price charts and trading volume to identify patterns and trends that can predict future price movements. Traders who utilize this method believe that past price action can reveal valuable information about potential future outcomes. By analyzing various technical indicators, such as moving averages, oscillators, and support/resistance levels, traders aim to generate trading signals that guide their entry and exit points.

Technical analysis is a popular approach among forex traders, but it's important to remember that it doesn't promise profits. Market conditions can change rapidly, and technical indicators are not always precise. Successful forex trading requires a combination of factors, including sound risk management practices, patience, and continuous learning and adaptation.

Utilizing Risk Management in Forex Trading

Successful forex trading isn't just about making profits; it's also about mitigating potential risks. Implementing robust risk management strategies is essential to consistent success in this dynamic market. A well-defined risk management plan entails a variety of methods such as trailing stops, position sizing, and asset allocation. By strategically utilizing these techniques, traders can minimize their exposure to potential losses and protect their capital.

Formulating a Successful Forex Trading Plan

A winning Forex trading plan is the cornerstone of sustainable success in this volatile market. It serves as your blueprint for navigating the uncertainty of currency fluctuations. Your plan should detail your approach, risk management, and profit goals. Deploy a robust set of rules that govern your purchase and exit points, guided by technical analysis and market conditions. Continuously analyze your plan's effectiveness, making tweaks as needed to optimize your success.

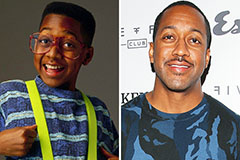

Jaleel White Then & Now!

Jaleel White Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!